San Jose Real Estate Agent – Market Update – San Jose CA

LOW INVENTORY

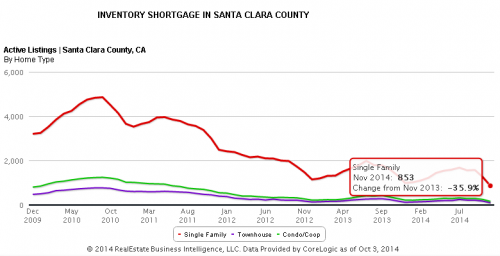

In Santa Clara County we currently have 496 single family homes and 110 condo/town homes on the market. It hasn’t been this low for as long as I can remember.

Last year we started the year with 539 single family homes and 212 condo/town homes and inventory almost doubled by April of 2014.

Compare this low inventory to the same time in 2009 when there were 1,731 single family homes on the market in Santa Clara County.

Tight real estate inventory means less homes to choose from. Home prices will increase if the demand is high. So let’s take a look at the sales pace. The San Jose real estate market has low inventory.

SINGLE FAMILY RESIDENCE INVENTORY – MONTHS SUPPLY

In Santa Clara County we currently have a 0.9 Months of Supply. Meaning, if we were to not take any more property listings and the 496 single family homes were to be left on the market, it would take less than a month to sell out. This is a fast paced real estate market.

Last year the real estate market was exactly the same. When compared to 2009 the number of months to sell out every sfh property goes to 2.2 months. This would be considered a normal real estate market at 2 months.

Is it better to rent or buy real estate? This is an important question that would-be buyers must answer. Home prices have gone way up the last few years and it takes more money to buy a home. This is a fast paced San Jose real estate market and a hot rental market.

CASH AND INCOME NEEDED FOR MEDIAN PRICE HOME

In order to buy a home you’ll need to have a cash down payment plus closing costs. With home prices going so high in the past few years it takes more down payment money to enter into a transaction and buy real estate.

The Median Price Home back in 2009 was $627,000 and so you would have needed approximately $150,000 cash to buy a single family home. In 2013 the Median Price Home was $756,000 and so you would have needed $181,000 cash to buy a home. Today, the Median Priced Home in Santa Clara County is $841,000 and you’ll need approximately $200,000 cash to buy a home in Santa Clara County.

In order to qualify for a home loan and buy a home in this real estate market you’ll need a good job with a good income. With the Median Price Home at $800,000, you’ll need to make a combined income of $141,000. This is the buyers’ combined income whether it’s a single person buying a home, married couple or anyone.

So what are your options? Well, you can always rent a home in San Jose and Santa Clara County. Right?

RENTS ARE WAY UP

Let’s take a look at our local rental market. In Santa Clara County the average rent is currently $2,720 per month. Last year it was $2,400. This represents an astounding 13.3% rent increase in just one year.

It’s good to be a landlord but not a renter. Rents will continue to go up in Santa Clara County.

INTEREST RATES ARE STILL LOW

The good news in real estate is that interest rates are still very low. The low interest rates allows buyers to qualify for more money. If the rates were to go from their current 3.875% to 6% on a $800,000 loan the payment would shoot up more than $1,000 per month (from $3,761 to $4,796). Keep in mind, there is still higher property taxes to pay and home insurance. The rates will go up this year according to all indications from local economists to national FED watchers.

QUICK 2015 FORECAST

In 2014, Home Prices in Santa Clara County went up 11.4% ($849,975 from $763,00). According to Michael Fleming Chief Economist with Core Logic, home prices are expected to rise 6% this year nationally. Core Logic also predicts that national home sales will rise 9% this year compared to last year.

If you don’t buy a home today with the low interest rates you might miss your opportunity to ever buy real estate. Don’t be stuck in a rental trap, take advantage of the low interest rates while they last.

Call San Jose Real Estate Agent – Daniel Pizano at (408) 460-8401 for more information.